Container market on the edge: election uncertainty and global volatility to persist well into 2025

- Pulling forward of orders to continue in Q4’24 as labor resolution postpones to January 2025

- Elections to cause greater uncertainty leading to container price volatility in the U.S. market, xCPSI shoots up in October

- Minimal impact of strikes on average container prices in the U.S.

Hamburg, Germany, 10 October 2024

As we enter October 2024, the U.S. container trading market is experiencing heightened volatility due to several influencing factors. The recent strikes at East Coast ports, which began on October 1 and have since concluded, have left a lasting impact on supply chains, while focus shifts to the U.S. elections scheduled for November 5.

” The recent strikes may have ended, but the storm is far from over. With unresolved issues surrounding automation, we are on the brink of another disruption come January 2025.,” shared Christian Roeloffs, cofounder and CEO of Container xChange.

Looking ahead, Roeloffs highlighted potential future challenges: “Given the unresolved issues around automation, I believe there are strong chances of another disruption in January. The unions strongly oppose any form of automation, and this unresolved matter raises the likelihood of another strike in January.”

Roeloffs urged U.S. container traders to prepare ”

Conversely, China is facing significant domestic challenges, with weak consumer spending and slowing income growth. While exports have shown resilience, broader economic concerns, including a slowdown in domestic consumption and property investment, could impact supply chains. Reduced demand for goods within China, coupled with U.S. retailers and wholesalers holding considerable inventory, is creating a more challenging environment for container trading and leasing companies, as lower shipping volumes and excess container capacity put pressure on both demand and leasing rates.

The Middle East is contributing to increased volatility in global container shipping, particularly in October 2024. Tensions have escalated between Israel and Iran, with Iran launching missiles at Israel and Hezbollah carrying out rocket attacks from Lebanon. These developments continue to disrupt perations in the Red Sea, where Houthi rebels are actively targeting vessels, intensifying shipping capacity strains with no immediate resolution in view.

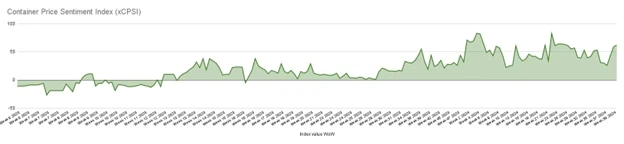

xCPSI Rises: Increased Expectations for Container Price hikes

The Container Price Sentiment Index (xCPSI) for September and so far in October, indicates a notable rise in the number of supply chain professionals globally anticipating an increase in container This expectation is driven by limited supply and steady demand.

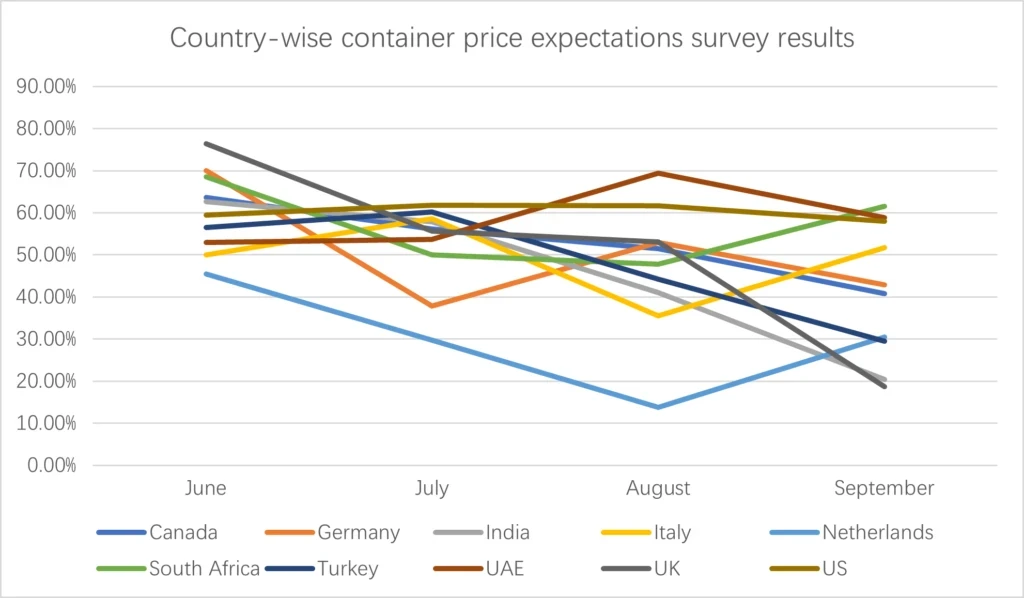

Country-level findings

No impact of U.S. East Coast strikes on average container prices

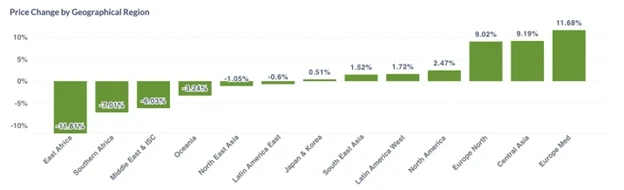

In September, average container prices in the U.S. remained relatively stable. However, on a global scale, Asia and Europe experienced the most significant price hikes, while the Middle East and the Indian Subcontinent (ISC) saw a 6% decline. An interesting development – the Middle East experienced a 7% price surge in early October, indicating market volatility in that region.

Additionally, supply is still coming offline from container factories, contributing to the overall decline in prices.

Region-wise average price development in September 2024

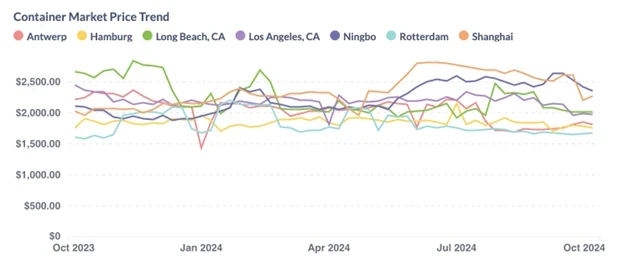

Currently, average container prices are highest in China, followed by the U.S. and then Europe. Prices have consistently fallen in both China and the U.S., while remaining relatively stable in Europe at a considerably lower level.

Key Factors influencing Q4 (Oct – Dec) 2024 container prices

- Impact of strikes and elections in November:

Although the strikes have concluded, the possibility of renewed labor disputes in January 2025 is a concern. Additionally, the upcoming U.S. elections introduce uncertainty, as trade policies could shift significantly depending on the outcome.

- Demand-Supply Dynamics:

In the short term, demand for U.S. containers appears stable. However, in the mid- to long-term, retailers and wholesalers are managing considerable inventory levels, which diminishes the need for significant imports, unless demand significantly bounces. The extent of inventory refilling required for the next cycle—aligned with the Chinese New Year—will primarily depend on the performance of peak season demand in the U.S.

- Cyclic Nature of Demand in Q4:

Traditionally, Q4 sees increased container demand due to the holiday season. While some stabilization in demand is anticipated as retailers work through their inventories, the full effects of peak season demand will likely become evident only in early 2025. Much will depend on how ongoing inventory adjustments unfold.

Roeloffs stated, “U.S. retailers are managing significant inventory levels, but the real challenge lies ahead. As we enter the holiday season, the dynamics between demand and supply will shift dramatically, revealing whether these inventories can maintain a healthy market or indicate deeper issues.”

Customer Insights

Conversations with U.S. container traders reveal cautious optimism regarding improving market conditions should Trump win the elections, potentially leading to policy changes that favor trade growth. Conversely, many container traders express concerns about ongoing global trade uncertainties and the residual effects of labor disputes, particularly as negotiations with the International Longshoremen’s Association (ILA) may resume in January 2025.

Will Frontloading Persist into Q4’24?

As we near the end of 2024, the U.S. container trading market i While supply remains tight, demand may experience significant fluctuations based on inventory levels, trade policies, and broader economic indicators. Traders and industry stakeholders should remain alert, especially with January 2025 negotiations on the horizon, reintroducing discussions about automation and future labor relations.

“With the Chinese New Year as the next key shipping season and fears of another strike looming, we’re entering a critical phase for importers. The rush to secure cargo now could shape the market well into 2025. How we navigate this will define our resilience as an industry.” Concluded Roeloffs.

2025 Outlook

Looking ahead to 2025, the U.S. container market will likely be shaped by the resolution of labor disputes and the broader geopolitical landscape. The outcome of the U.S. election will significantly , subsequently affecting container prices. The topic of automation will remain prominent, as the ILA is anticipated to revisit this issue in their forthcoming negotiations.

Globally, the persistent conflicts in Eastern Europe and the Middle East will continue to disrupt supply chains, with no immediate resolution on the horizon. The true test for container demand will arise once inventories are depleted, providing clarity on actual consumer demand. Early 2025 will be a critical period to evaluate how much of the Q4 2024 peak season demand translated into sustainable consumer activity.

The slowdown in factory output in China is impacting global supply chains, diminishing the volume of goods available for export, which, in turn, affects container shipping demand.

The late 2024 Chinese market is characterized by a combination of economic deceleration, declining export demand, and excess inventory in the container shipping sector. Efforts to stimulate growth through infrastructure investments are yet to sufficiently counteract the effects of weaker global demand. Stakeholders in container shipping should brace for continued volatility and reduced demand, especially for exports from China to major markets like the U.S. and Europe.

The Mexico Story

Mexico’s rise as a significant trade hub is fundamentally transforming U.S. container availability and logistics. As companies move production from China to Mexico to take advantage of the USMCA and avoid U.S. tariffs, there has been a remarkable 26.2% increase in container trade between China and Mexico, alongside record border crossings at the U.S.-Mexico border, particularly in Laredo, Texas, which has emerged as a key logistics center.

This shift is driving increased demand for cross-border trucking and rail services, highlighting the urgent need for expanded container facilities at the border, and represents a strategic change from direct China-U.S. routes to China-Mexico-U.S. routes.

Roeloffs commented, “For container traders, this translates to a decrease in container availability in inland U.S. locations, which is likely to push trading prices higher. Furthermore, with the increased demand for cross-border trucking and rail services, along with the need for expanded border container facilities, the transition from direct China-U.S. routes to China-Mexico-U.S. routes will be a crucial trend to monitor.”

For similar analysis, reports and commentaries, and to keep yourself updated about the macro events impacting the container logistics industry, visit Container xChange Market Intelligence Hub.

Download the Global Forecaster.

Delda Nurlan, Partnerships Manager at Container xChange | Contact: dnu@container-xchange.com

Container xChange is a container marketplace that connects container logistics players globally to buy, sell and lease containers.

About Container xChange

With a mission to simplify the logistics of global trade, Container xChange is a leading digital marketplace for container trading and leasing, revolutionizing the container logistics industry. Container xChange connects a global network of container traders, leasing companies, shipping companies, freight forwarders, and container owners and users. The platform provides comprehensive solutions for container leasing, trading, and management, leveraging real-time data and advanced analytics to streamline operations associated with moving containers globally. With a focus on enhancing efficiency and transparency, Container xChange helps businesses navigate the complexities of the global supply chain, reduce costs, and optimize container utilization. Committed to driving innovation and sustainability in container logistics, Container xChange empowers industry stakeholders to adapt and thrive in a rapidly evolving and volatile container shipping market.