Will the H1 Boom Continue in H2 of 2024 for the Container Logistics Industry?

- Hong Kong and Vietnam witness the biggest month-on-month spike in average container prices in June

- China experiences the largest container price hike since the Houthi attacks, up by 78% since October 2023

- Market Outlook for H2 indicates cooling of container rates

Hamburg, July 8, 2024:

Container xChange, the leading digital marketplace for container trading and leasing, has released its mid-year container market forecaster. The analysis delves into container price developments in H1 2024 and offers a market outlook for H2 2024.

“As we move into July, we’re seeing a continued rise in freight rates, container prices, and leasing rates, driven by ongoing geopolitical tensions and resulting supply chain disruptions. The diversions around the Cape of Good Hope and the resulting congestion in major ports have created a perfect storm, causing importers in the US and Europe to pull forward orders in H1 typically reserved for Q3. This has led to a notable supply-demand imbalance. While we might see a peak in July followed by a reduction in freight rates due to easing congestion and reduced demand, the ongoing conflict in the Middle East and potential new disruptions, such as labor strikes, could prolong these challenges. The container shipping industry remains on high alert, adapting to an ever-changing landscape.” Inferred Christian Roeloffs, cofounder and CEO, Container xChange

H1 2024 Container rates Recap

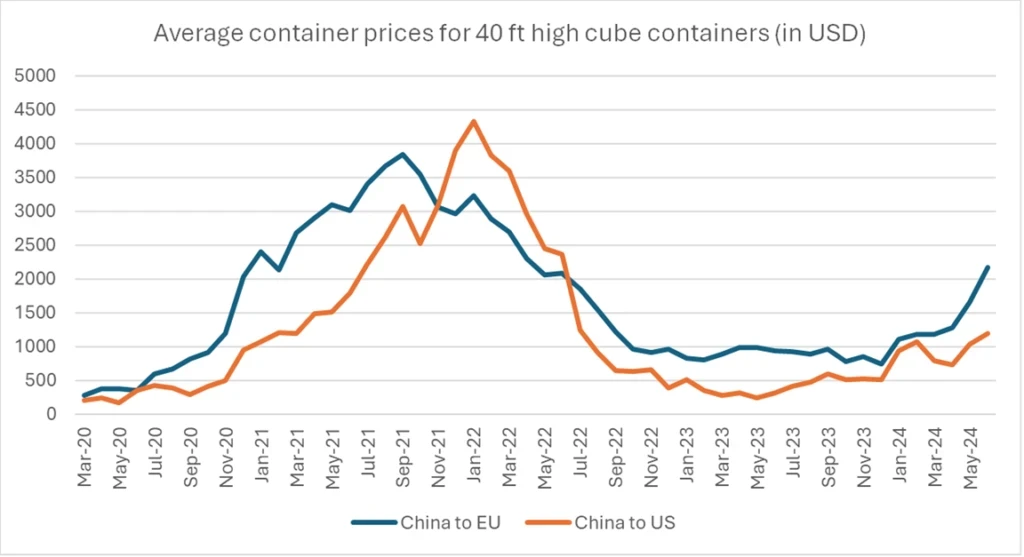

Globally, shipping costs have surged in the first half of 2024, defying the traditional off-season lull

Asia and Middle East and the ISC regions were the regions that witnessed a significant uptick in container prices since October 2023 due to the Houthi attacks.

On the other hand, container prices remained stable or decreased, reflecting an abundance of containers in traditional import destinations. These prices have now begun to move upwards. Our mid-year forecaster gives a review of global container price developments to offer greater visibility into the trends observed during the first half of the year.

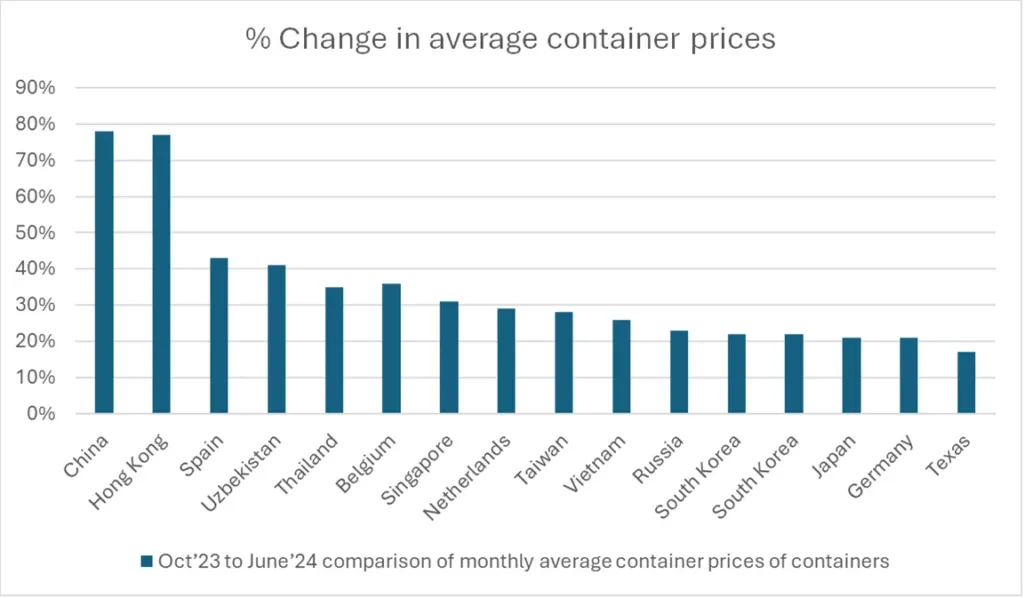

Main destinations that experienced significant container price upticks in H1’2024

Average container prices continue to rise through May and in June. Hong Kong and Vietnam experienced the biggest month-on-month percentage spike of 35% from May to June for trading containers, followed by China (27%), Russia (24%), Taiwan (23%) and Malaysia (23%).

India also faced a rise in average container prices spiking by 21% from May to June 2024. In Singapore, while there has been a steady rise of 31% in container prices since October 2023, the increase from May to June 2024 was a more moderate 7%.

In terms of the impact of the Houthi attacks, China stood out by a significant leap at 78% container price hike from October’23 to June’24, followed by Hong Kong (77%), Spain (42%), Uzbekistan (40%) and Thailand (35%).

Malysia (29%), Netherlands (29%), Taiwan (28%) and Vietnam followed the pack of biggest price increases since October for container prices. (40 ft high cube, cargo worthy containers)

China and Hong Kong have the highest average container prices currently across the world, namely, $3600 and $3124, respectively.

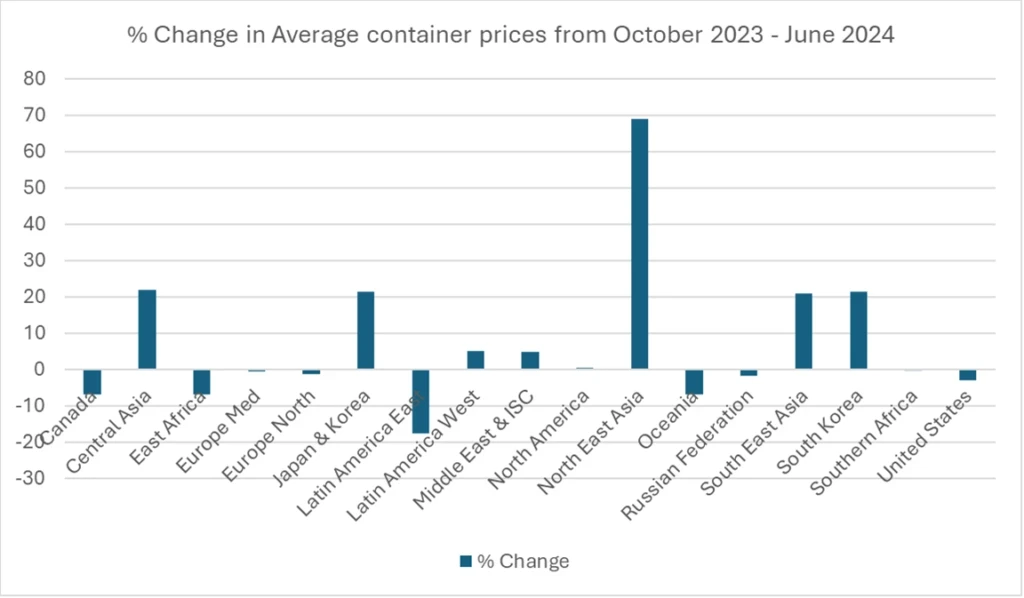

Region-wise analysis of Impact of Houthi attacks on container price development

To understand the trajectory of container prices development, it becomes important to study the impact that Houthi attacks have had on these. Here is a region-wise impact analysis on the container prices pre-Houthi attacks and until June 2024.

Northeast Asia region witnessed the biggest price increase of 69% since October 2023, with China, Hong Kong and Taiwan registering significant price hikes, indicating robust demand for containers.

Container prices have been on an upward trajectory across Central Asia, the Middle East, the Indian Subcontinent (ISC) region, Japan and Korea and both Northeast and Southeast Asia.

Tony Yu, president, Baiscon Shipping Line Hong Kong Co., Limited with the company headquartered in China and one of our top sellers in the US shared exclusive insights from the ground.

“From January to June of 2024, containers in the North American market were in a state of clearing inventory and prices showed signs of rising. It will continue to rise in the next few months, which is in line with the increase of container purchase price in the Chinese Mainland. The high cost of container procurement and container leasing lead to almost no difference between SOC freight and COC freight. Based on this performance, the lack of containers in some cities in North America is inevitable, which will drive up the sales price of containers.”

Looking into the second half of 2024, Tony expressed optimism tempered by practical challenges.

Discussing significant market drivers and developments for the second half of 2024, Tony emphasized, ” We need to consider several factors that affect the market: the Red Sea crisis and the subsequent diversions and the situation of China’s own foreign trade exports. If the situation does not improve, it will lead to strong container sales in North America. However, the influence of exchange rates cannot be ruled out. Should the Federal Reserve lower interest rates, the resulting appreciation of RMB could potentially have an auxiliary effect on the stability of container prices. Personally, I feel that there will not be too much change in the second half of the year”

Building on these insights, Daniel Nee, President of Holyidea Logistics Equipment Manufacture Co., Ltd., (a Container xChange customer based in China) emphasizes the ongoing complexities and unpredictability in the global landscape as pivotal factors which will continue to influence the container industry in the second half of 2024.

“As we look ahead to the second half of 2024, the global situation remains highly complex and unpredictable, leading us to anticipate further challenges in the container industry. The most significant factor shaping the market will be the geopolitical risks, and we must wait for changes on the global stage before making any definitive industry judgments. My advice to peers is to approach the market with patience and resilience. We are preparing for these uncertainties by waiting quietly and observing the evolving global context.”

Container market remains bullish of further price hikes

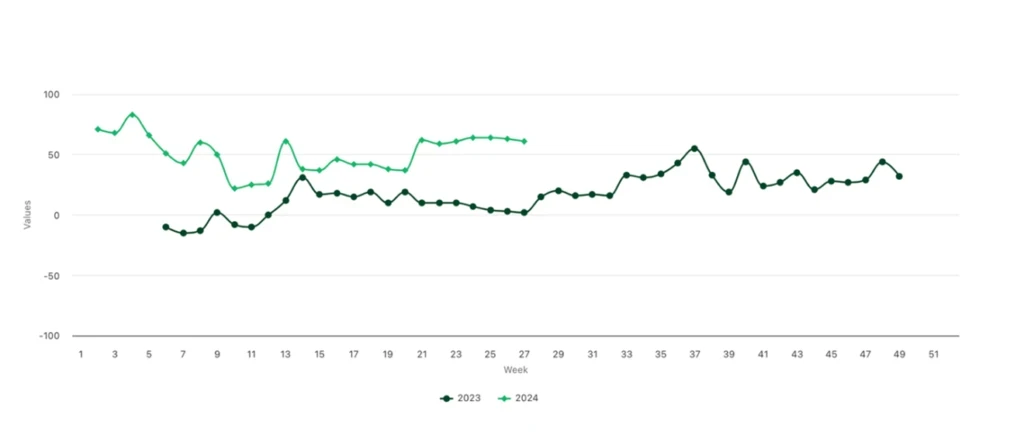

Chart: Container Price Sentiment Index (xCPSI) as on 3 July 2024

The first half of 2024 saw the Container Price Sentiment Index (xCPSI) reach an all-time high, and it remains elevated throughout the last six months, indicating a strong sentiment for rising container prices expectations in the upcoming second half of the year.

United States: Container demand spikes, container prices begin to rise

“In recent months, the US container trading market has significantly slowed, primarily due to sharp price increases. Container sellers in the US have held onto stock, anticipating higher prices, while container buyers in US have adopted a cautious stance, awaiting potential price drops. This cautious market behavior has affected our container buyer’s purchasing decisions. There are several factors at play, with a significant impact on the US market, being the impending election and discussions surrounding potential tariffs on Chinese goods. This has spurred heightened demand for shipping containers, driving prices upwards and creating market uncertainty, which in turn has deterred buyers from making immediate purchases. Additionally, the extended route due to the Red Sea situation has exacerbated supply chain disruptions, further influencing market dynamics.” commented Isabella Zomignani, Associate Account Manager, Americas, Container xChange.

Asia continues to grapple with rising container prices and leasing rates in July

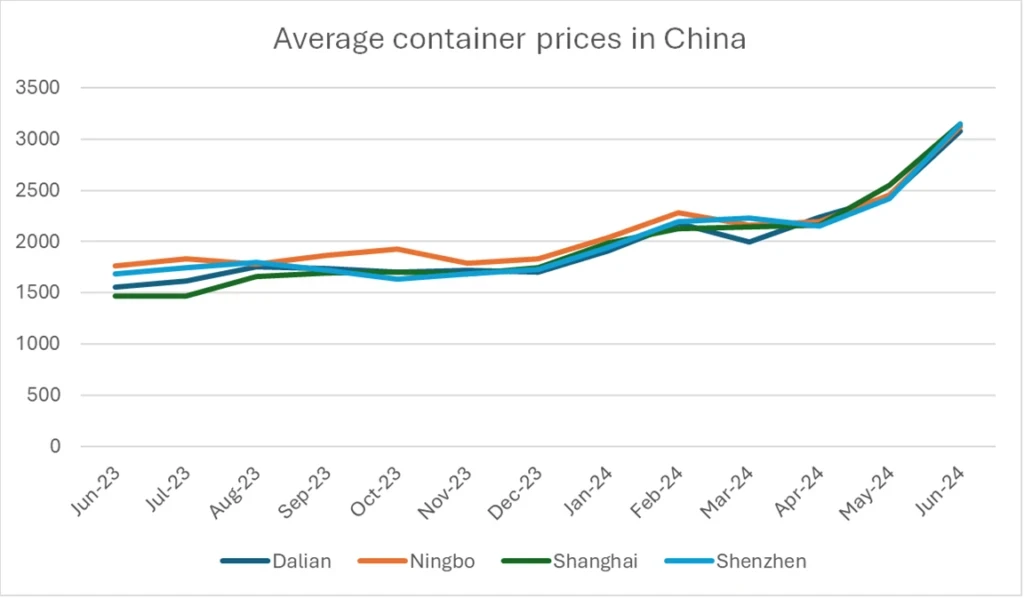

Average prices for 40 ft high cube containers (cargo worthy) in China

Source: Container xChange, Insights tool

“In June, we’ve observed a continued rise in container prices in China, impacting both trading and leasing activities. The scarcity of available slots for China-Europe and China-USA routes has intensified, prompting offline suppliers to offer competitive prices to attract customers. This temporary price decrease reflects urgent liquidity needs among suppliers. Moving forward, we anticipate prices to rebound next month as slot availability tightens again.” shared Haoze Lou, broker team, Container xChange.

Market Outlook: H2 2024

The market outlook for the second half of the year is heavily contingent on a revival in consumer demand. Several factors will influence this period, including ongoing geopolitical disruptions and potential labor unrest.

Firstly, we foresee the Houthi attacks to continue and disrupt supply chains with no foreseeable resolution, exacerbating market uncertainties. Additionally, labor unrest in the US east and gulf ports remains a significant potential disruption, with the possibility of flare-ups impacting supply chains further in the latter half of 2024.

However, if the current market conditions persist without major changes, we expect container rates to ease. This reduction in rates could trigger an uptick in container buyer activity, as the buyer side is currently waiting for prices to decline before resuming trading and leasing activities.

Furthermore, according to Alphaliner, the global container fleet grew by 10.6% between June 1, 2023, and June 1, 2024. We anticipate that the introduction of more container fleets into the market will help alleviate some of the price pressures, potentially stabilizing the market and fostering increased trading activity.

Visit Container xChange Market Intelligence Hub for similar analysis and reports.

About Container xChange

Container xChange serves as a global online marketplace for container trading and leasing, connecting container users with owners. The platform streamlines the process of finding and exchanging containers, optimizing fleet management, and fostering collaboration across the shipping industry.

The neutral online marketplace –

Connects supply and demand of shipping containers globally and assists with transportation services with full transparency on container availability, pricing, and reputation,

Simplifies operations from pickup to drop-off of containers, and

Auto-settles payments in real-time for all your transactions to reduce invoice reconciliation efforts and payment costs.

Currently, more than 1700+ vetted container logistics companies trust xChange with their business—and enjoy transparency through performance ratings and partner reviews. Unlike limited personal networks, excel sheets and emails that the industry generally relies upon, Container xChange gives its users countless options to book and manage containers, move faster with confidence, and increase profit margins.

Delda Nurlan, Partnerships Manager at Container xChange | Contact: dnu@container-xchange.com

Container xChange is a container marketplace that connects container logistics players globally to buy, sell and lease containers.