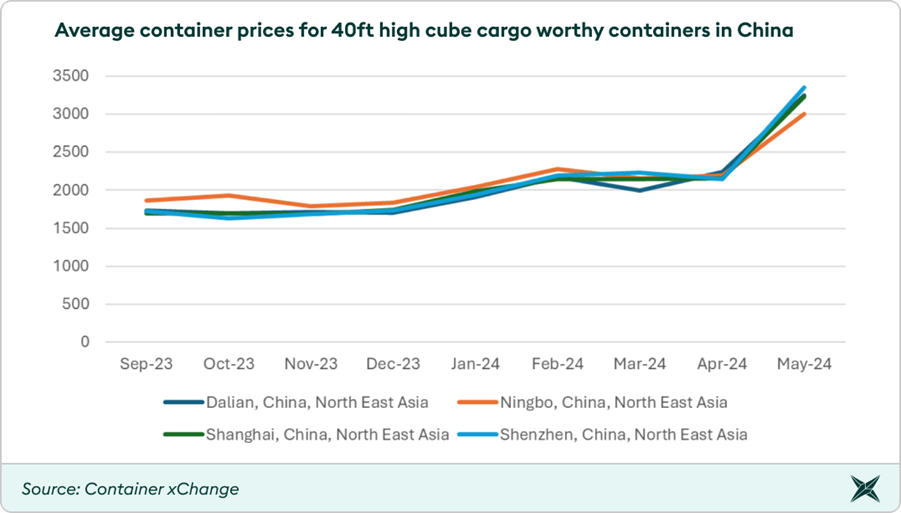

Container xChange recently unveiled its June container market forecaster, revealing trends and insights that are shaping the global container shipping market. The forecaster highlights the dramatic rise in container prices in China recently, which surged by 45% in May. Meanwhile, container prices have remained relatively stable in the US and Europe.

Chart 1: Average container price trends across key ports in China for 40 ft High cube cargo-worthy containers

Chart 1: Average container price trends across key ports in China for 40 ft High cube cargo-worthy containers

Capacity shortage and unexpected demand increase are main drivers of price surge

Christian Roeloffs, co-founder and CEO of Container xChange, stated, “Shippers are pulling shipment dates forward, resulting in a temporary demand for shipping capacity. This is reflected in higher throughput volumes, despite underlying consumer demand and factory orders being weak. Consumer spending in the US increased by only 2% in the first quarter of 2024, below the advance estimate of 2.5% and the lowest increase in three quarters. Also, retail inventories excluding autos in the US increased by only 0.3% month-over-month in April 2024, following a 0.4% decline in March 2024, indicating only cautious restocking by retailers. Additionally, new orders for manufactured goods in April rose by $4.3 billion, a 0.7% increase to $588.2 billion, while shipments increased by $5.9 billion or 1% to $590.2 billion, signaling robust demand in the shipping and container logistics market.”

Short-term Price Bubble

As we monitor the market closely, it’s evident that the current spike in container prices is not sustainable in the long term, as it is not backed by strong underlying demand. Concerns over labor markets and high-interest rates imply that consumers are likely to reduce spending, which could lead to a decline in demand for goods and, consequently, a reduction in shipping volumes in the near term, unless the demand revival becomes stronger and the supply capacity soak up intensifies.

Market Outlook

“Given these factors, we expect that the elevated container prices we’ve seen in recent months may not be sustainable,” shared Christian Roeloffs, co-founder and CEO of Container xChange. “As the initial rush to restock inventories subsides and the real demand from consumers and businesses remains flat, we anticipate a stabilization or even a decline in container prices in the mid-term. The market is showing signs of volatility driven by short-term factors, rather than a sustained increase in demand.”

The underlying macroeconomic indicators suggest a more tempered outlook for the coming months. Consumer spending growth remains sluggish, and retail inventories are only modestly increasing. Additionally, the subdued consumer sentiment reflects ongoing concerns about labor markets and inflation, which are likely to dampen consumer demand further.

Read more about the Global Forecaster.

Visit Container xChange Market Intelligence Hub for similar analysis and reports.

Delda Nurlan, Partnerships Manager at Container xChange | Contact: dnu@container-xchange.com

Container xChange is a container marketplace that connects container logistics players globally to buy, sell and lease containers.